In Which Situation Would A Savings Bond Be The Best Investment To Earn Interest?

In which situation would a savings bond be the best investment to earn interest?. Savings bonds have been one of the most popular investments in the United States since 1935 1 and perhaps the Series EE savings bond is the most well known. In fact you could earn more money by putting your money in an online savings account in some cases. As a result bond funds are better investment options for passive traders.

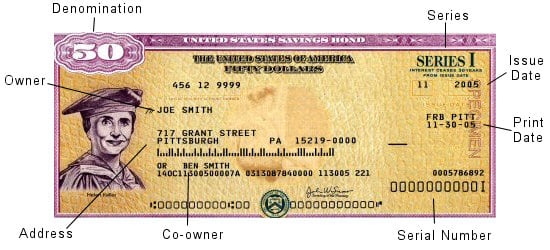

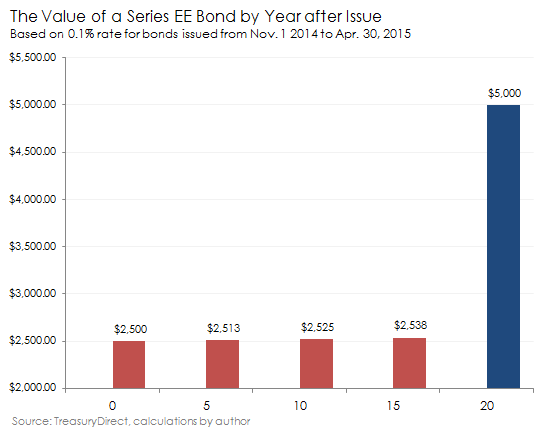

Savings bonds earn interest for 30 years but you can withdraw penalty-free after five years. Savings bond is guaranteed to double in value over 20 years and it can keep earning interest if held for up to 30 years. However EE bonds have fixed interest rates as of 2005 that are similar to what you might find in a bank savings account at the time of purchase.

Every six months from the bonds issue date all interest the bond has earned in previous months is in the bonds new principal value. A few savings bonds allow a limited number of penalty-free withdrawals but most charge a penalty in the form of loss of interest if you want to take out any money before the bond matures. It is essential to do proper research on how creditworthy the bond issuer is.

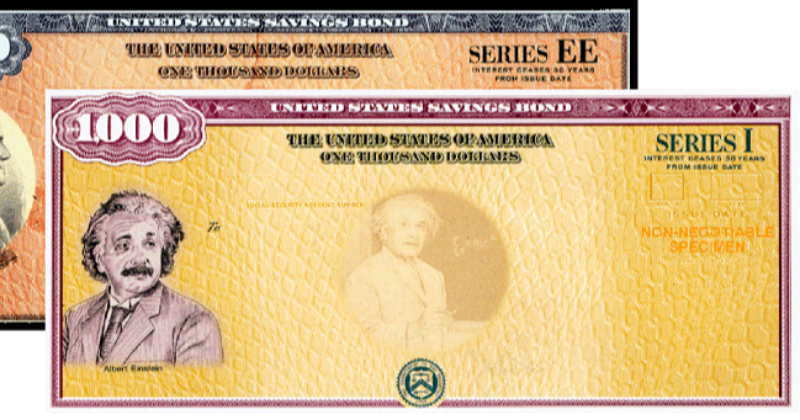

There are two types of savings bonds. For example in month seven interest is. If youre familiar with certificates of deposit you could think of a savings bond like a 30-year CD.

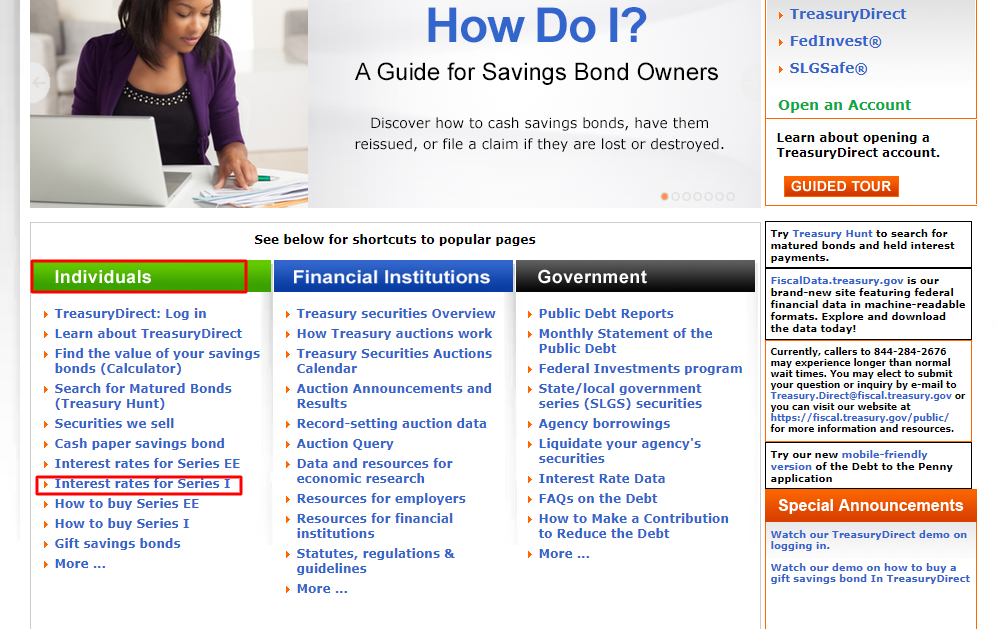

Savings bonds are among the safest of investments backed by the full faith and credit of the United States government. Many bond funds can be traded at expense ratios below 1. The low-cost of buying bond funds make it.

With a holding period from 12 months to 30 years you could own them as an alternative to bank certificates of deposit they are. However interest rates on savings bonds arent always great. O if you need access to your cash quickly O if you are saving each month for a new car O if you are putting aside a chunk of money to purchase a house in five years saving to pay a tax bill in four months.

The Series EE savings bonds issued since May 2005 earn a fixed rate of interest for the life of a bond. Interest is earned on the new principal for the next six months.

The low-cost of buying bond funds make it.

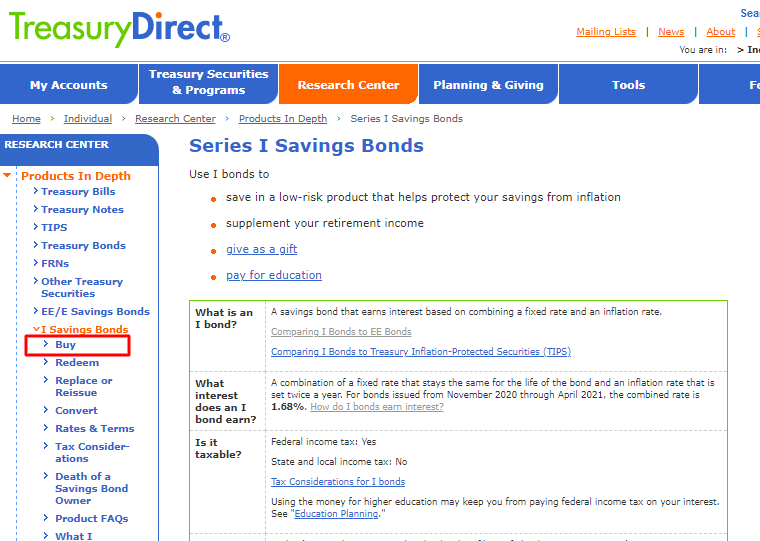

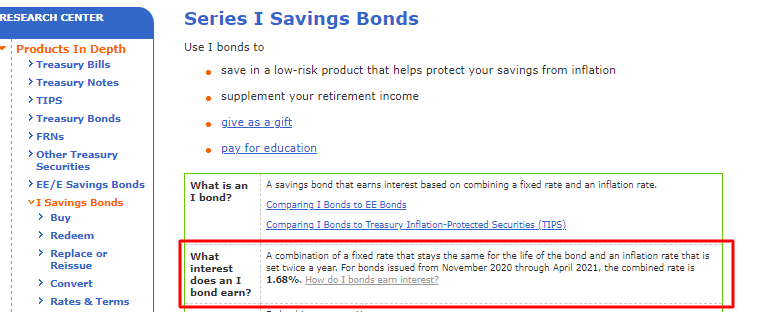

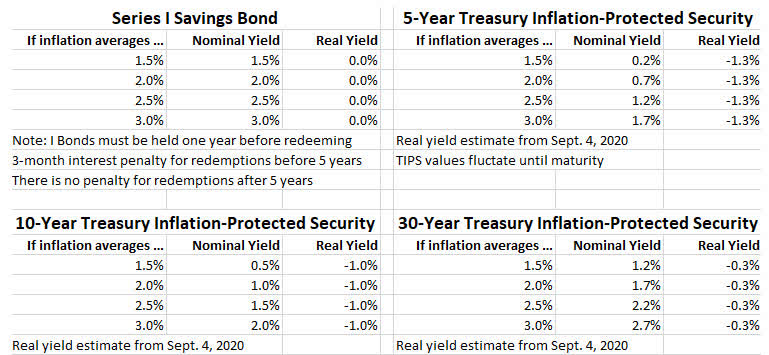

Every six months from the bonds issue date all interest the bond has earned in previous months is in the bonds new principal value. As a result bond funds are better investment options for passive traders. For example in month seven interest is. The Series EE savings bonds issued since May 2005 earn a fixed rate of interest for the life of a bond. A few savings bonds allow a limited number of penalty-free withdrawals but most charge a penalty in the form of loss of interest if you want to take out any money before the bond matures. However EE bonds have fixed interest rates as of 2005 that are similar to what you might find in a bank savings account at the time of purchase. They pay interest for 30 years. Savings bond is guaranteed to double in value over 20 years and it can keep earning interest if held for up to 30 years. Savings I Bonds are a unique low-risk investment backed by the US Treasury that pay out a variable interest rate linked to inflation.

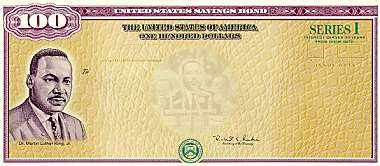

2 Issued by the Department of the Treasury to help raise money to fund the government Series EE savings bonds allow investors to buy bonds in much smaller denominations than traditional corporate or municipal bonds. Savings I Bonds are a unique low-risk investment backed by the US Treasury that pay out a variable interest rate linked to inflation. Savings bonds are issued by the government. So there are two types of bond returns. Savings bonds earn interest for 30 years but you can withdraw penalty-free after five years. If youre familiar with certificates of deposit you could think of a savings bond like a 30-year CD. Savings bond is guaranteed to double in value over 20 years and it can keep earning interest if held for up to 30 years.

/united-states-savings-bonds-of-varying-amounts-182885962-57daad0f3df78c9cceaa3930.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/united-states-savings-bonds-of-varying-amounts-182885962-57daad0f3df78c9cceaa3930.jpg)

/ee-savings-bonds-139259410-5ac19e1ca474be0036067b55.jpg)

/HowDoIBuySeriesEESavingsBonds-565be2aa3df78c6ddf5df68e.jpg)

:max_bytes(150000):strip_icc()/GettyImages-637141824-8aa32cebbf5847c1948f9fcda236ad9d.jpg)

/GettyImages-841087530-5cd078636491472abfe3a4ac2f222863.jpg)

/series-ee-savings-bonds-maturity-dates-59f7e4ceaad52b0010fd0da0.jpg)

Post a Comment for "In Which Situation Would A Savings Bond Be The Best Investment To Earn Interest?"